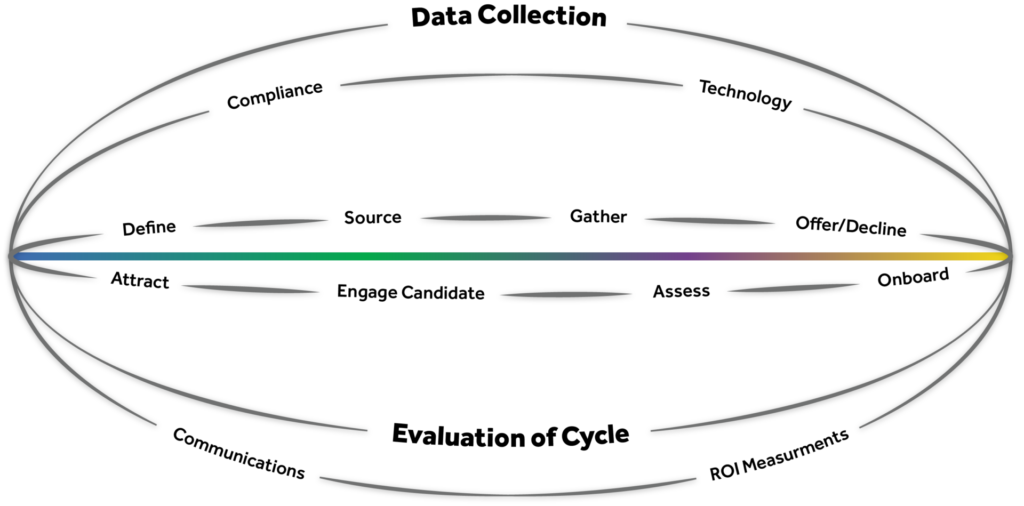

The recruiting continuum depicted here occurs naturally for each recruiting effort.

By identifying the segments of the recruiting continuum and measuring their current effectiveness, we can begin to address what work can be performed by People Science to assist an organization in reaching optimum results.